Introduction When your salary or pension gets revised and you receive arrears for previous years, it often leads to higher tax deductions in

Introduction When your salary or pension gets revised and you receive arrears for previous years, it often leads to higher tax deductions in

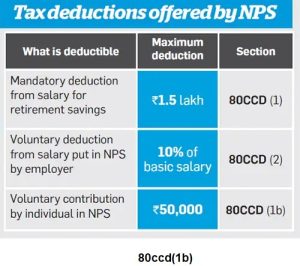

Deduction under Chapter VI-A for the Old Tax Regime as per Budget 2025

1. Introduction to Chapter VI-A Deductions When it comes to tax planning in India, Chapter VI-A of the Income Tax Act plays a

LIC FD 2025: ₹1 Lakh Deposit with Guaranteed ₹6,500 Monthly Income

Are you seeking a secure investment that yields a steady monthly income with minimal risk? Imagine planting a tree that provides fruits every month without

LIC FD 2025: ₹1 Lakh Deposit with Guaranteed ₹6,500 Monthly Income

Are you seeking a secure investment that yields a steady monthly income with minimal risk? Imagine planting a tree that provides fruits every month without

Most of us keep a savings account, but here’s the catch—the interest you earn on it is taxable. Many people don’t realise that

Understanding Section 87A Rebate in Income Tax The Income Tax rebate under Section 87A is a significant relief for individuals with lower income

Good news is on the horizon for businesses and taxpayers in India. The Central Board of Indirect Taxes and Customs (CBIC) is working

Budget 2025 has completely reshaped the Income Tax Act, 1961. From 1st April 2025, every salaried employee, business owner, and investor will experience

Optional Tax Regime U/s. 115BAC: Exemptions & Deductions Not Allowed

Introduction Have you ever felt confused by the endless list of exemptions and deductions on your income tax return? You’re not alone. For

Introduction The Union Budget 2025 brought significant tax changes that directly impact salaried individuals, government employees, and non-government employees alike. Many taxpayers are

Every year, salaried employees face the same pressing question: Should I choose the Old Tax Regime or the New Tax Regime for F.Y.

Introduction: Section 87A Tax Rebate and CBDT’s Latest Circular The Central Board of Direct Taxes (CBDT) has addressed a long-standing issue faced by

Income Tax Exemption from Interest from Savings Account under Section 80TTA with Automatic Income Tax Preparation Software All in One in Excel for

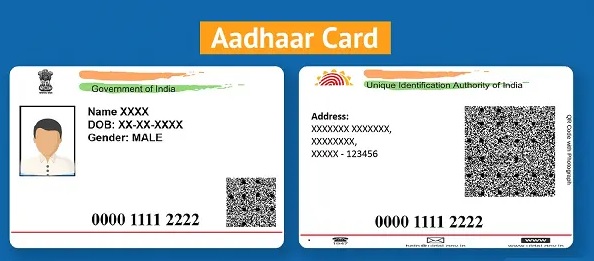

Aadhaar Card Update Online September 2025: Step-by-Step Guide to Correct a Spelling Mistake

Since the Aadhaar card serves as a crucial proof of both identity and address, it is essential to update your details regularly. By

Which ITR Form Applies to Your Income for Income Tax Filing FY 2024-25 (AY 2025-26)?

Introduction When it comes to Income Tax Filing for A.Y.2025-26, most taxpayers face a common question: Which ITR form should I file? The

Section 115 BAC of the Income Tax Act as per Budget 2025

The Government of India introduced Section 115 BAC of the Income Tax Act to simplify taxation for individuals and Hindu Undivided Families (HUFs).

Introduction Are you earning up to ₹12.75 lakh annually and wondering which tax regime is best for you? You are not alone. With

The New GST Rates with Effect from 22nd September 2025

Have you ever wondered how changes in GST impact your everyday shopping bill? From milk and medicines to footwear and household items, the

Introduction Are you considering the new tax regime but still unsure if it’s the right choice? You’re not alone. Many salaried individuals and

Tax on Savings Bank Interest: Complete Guide to Deductions Under Section 80TTA for the F.Y.2025-26

A savings bank account is one of the most common financial tools that almost every individual holds. While it helps in keeping money

© Copyright 2023 All Rights Reserved by Pranabbanerjee.com